Feature spotlight: Seller disclosures in Transact (zipForm Edition)

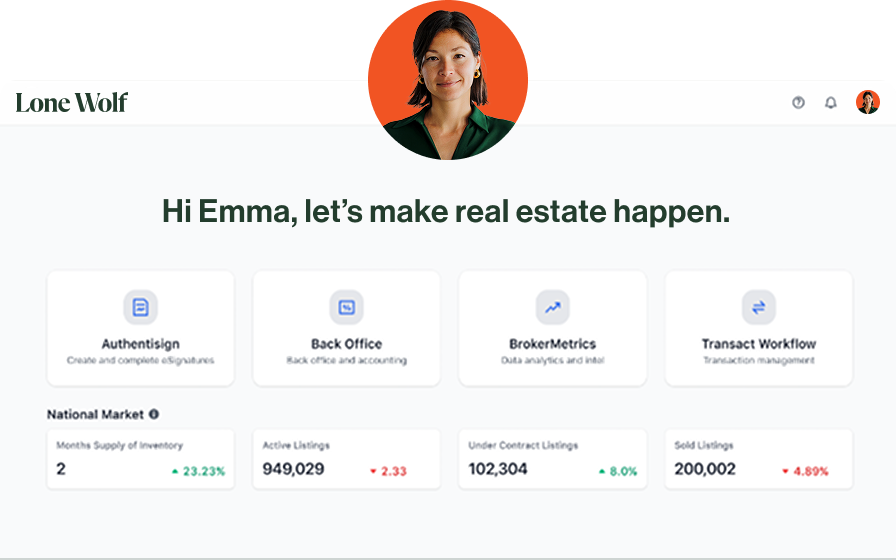

Lone Wolf Transact (zipForm Edition) is more than a transaction management solution.

It also connects with some of the best and brightest tech companies in real estate to give our customers everything they need for the entire homebuying and selling journey.

Disclosures are extremely important part of any transaction, especially with current market conditions. That’s why we’ve partnered with Sellers Shield, a leading home seller protection provider. Sellers Shield is available in Transact (zipForm Edition) and can be found on the transaction dashboard. It’s a simple and surefire way to protect your sellers with every deal.

Why disclosures matter now more than ever

People are buying houses at high (sometimes outrageous) prices, sight unseen, inspections waived, and all in cash. However, as home prices start to deflate over the coming months, the climate may become more litigious, with an increasing number of home buyers suing sellers for repairs on homes they feel they paid a bit too much for.

What agents need to know about liability

If one of your home sellers does receive a demand letter or, even worse, is named in a lawsuit, you have protection through legal representation provided by your E&O insurance. Brokers and inspectors enjoy the same protection. However, this doesn’t mean agents avoid a trip to the courtroom: sellers are the only ones in a real estate transaction without legal protection. This means the seller is the buyer’s most vulnerable target for a lawsuit. If the seller is sued, they may drag their agent into the lawsuit in an attempt to deflect responsibility and reduce the burden of the accusation. While E&O insurance helps provide legal representation in these cases, it cannot prevent agents from being involved in a lawsuit.

While protecting sellers and fulfilling fiduciary duty is always top of mind for real estate agents, protecting your business from the financial and professional devastation of a lawsuit should also be considered. Luckily, there is a simple, free, and insurance-supported method agents can follow to reduce their liability on every home sale.

What sellers need to know about liability

The seller is often completely unaware they can be sued after the sale, making the reality of a lawsuit even more devastating. After receiving a demand letter asking for an average of $54,000 in compensatory damages, sellers are left to fight a stressful and lengthy legal battle alone.

- Sellers are often frustrated when forced to deal with a property they’ve figuratively and literally moved on from

- Retainer fees for an attorney to represent them are easily up to $14,000, if not higher

- And they often pull their agent into the lawsuit as part of their defense strategy, even if they don’t want to

Fortunately, Sellers Shield works to protect sellers in the event of a home sale lawsuit, and also limits the likelihood of a lawsuit in the first place. Agents, brokers, and sellers can now enjoy peace of mind when it comes to their business and move forward with their lives.

Peace of mind with Home Sale Legal Protection™

Sellers Shield created Home Sale Legal Protection™ to defends sellers if the buyer sues them, or even just threatens to sue them.

- Supports the seller from start to finish

- Immediately assigns a local, qualified real estate attorney

- AND pays the legal fees up to $20,000.00

The gold standard in disclosure forms

Sellers Shield protects sellers in the event of a lawsuit with Home Sale Legal Protection™, but also reduces lawsuits from happening in the first place via the forms themselves. Because disclosure form errors are the #1 cause of these legal disputes, Seller Shield’s legal experts created a disclosure form process that both reduces agent liability and limits the likelihood of a lawsuit in the first place.

Agents lower their liability risk:

- Guidance for the seller throughout the forms means agents are less likely to be asked questions about how to answer

- Creates distance between the agent and the disclosure process which protects agents in court

Sellers reduce their odds of a lawsuit:

- Examples, tips, and definitions guide sellers through the disclosure process

- Expandable fields so sellers can elaborate on complicated issues

- Support for the seller from start to finish

How to get started

The best way to prevent a lawsuit is to educate sellers on the importance of accurate disclosures and to send gold standard disclosure forms through your Transacti (zipForm Edition) portal. This proactive disclosure process means a reduction in the risk of a buyer taking legal action.

However, it’s essential to remember that no matter how good you are at your job, or how honest your seller may be, the reality is that lawsuits happen and sellers deserve protection. Tell your sellers about Home Sale Legal Protection™ so they never have to go through the emotional and financial devastation of a lawsuit – and your real estate business won’t have to, either.

Other resources

See more eBooks, webinars, and blog articles to help you stay ahead with strategies designed for your success.